Tax Time

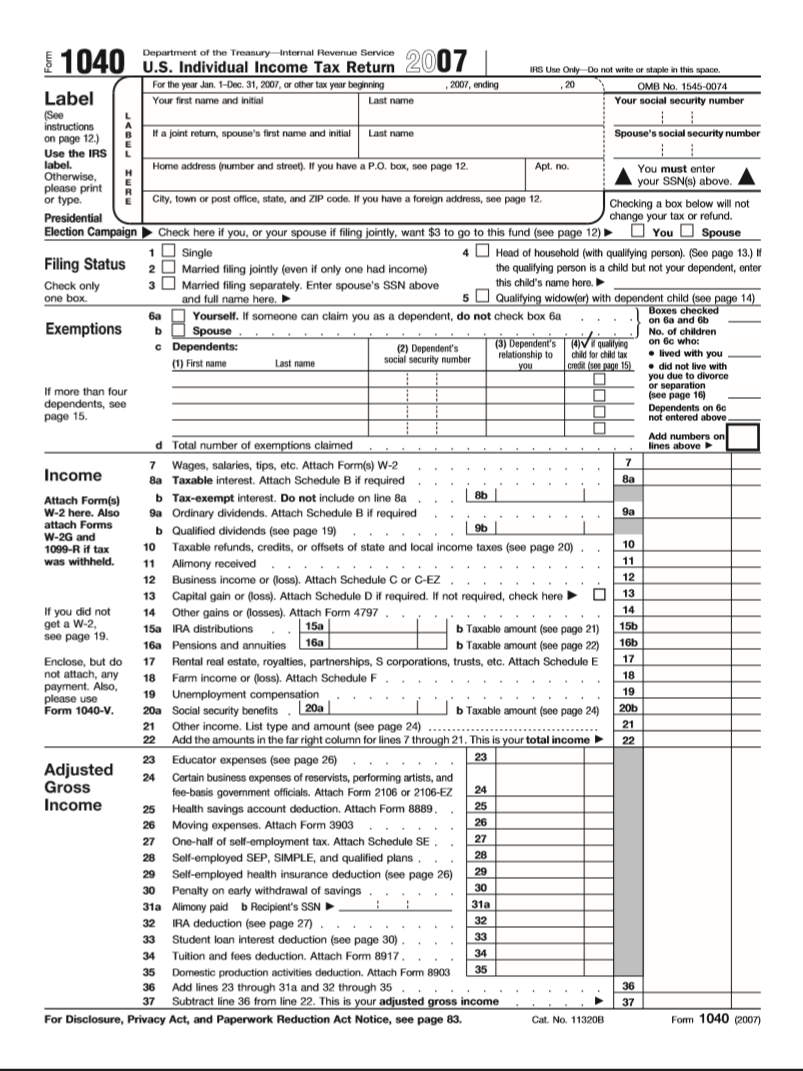

I’m an advocate of doing taxes yourself (using tax software)—except in the most complicated scenarios—as that is one of the best ways to learn about and understand your country’s tax codes and tax breaks. It also can ensure your taxes are done correctly (since, most likely, you know your financial situation better than any tax preparer?) and helps one to plan ahead for the future (i.e., how to take advantage of tax deductions going forward).

So I’ve always done my taxes myself, but for the second year in the row, I am done with them two months early. Yes, done! Done! Did I say done?

Anyhow, one thing I found interesting was something that TaxAct told me after I finished my taxes last week: how tax dollars are being used by the U.S. government. This is the breakdown:

| Category | % of Tax Dollars |

|---|---|

| Social Security, Medicare, and Other Retirement | 36% |

| National Defense | 19% |

| Medicaid, Food Stamps, and Related Programs | 13% |

| Physical, Human, and Community Development | 12% |

| Interest Payments | 8% |

| Unemployment and Social Services | 6% |

| Veterans and Foreign Affairs | 4% |

| Law Enforcement and General Government | 2% |

A few thoughts:

- Apparently, over one-third of U.S. tax dollars goes towards retirement purposes, including Social Security and Medicare. I have no problem with that. At least those dollars come back into our pockets or help take care of us in the future (in theory, at least!)—assuming the Social Security system remains solvent.

- It is sobering to think, however, that about one out of five tax dollars is needed for national defense (or national offense, in the case of Iraq). I’m not necessarily suggesting this isn’t prudent (indeed, there have been plenty of presidential candidates, especially on the Republican side, who want to spend more on this), just that it’s sad that the world is still imperfect enough that politicians think this is necessary.

- Actually, if you add the amount we are spending on veterans and foreign affairs to national defense, 23% (or almost one out of four) of our tax dollars is spent on items related to national security or the military.

- It is curious to me that ten times more dollars are spent on national defense than domestic law enforcement—especially when considering that to people in places such as Stockton, California, everyday thugs and criminals pose a much greater threat to their livelihoods than foreign “enemies.”

- It’s also disappointing to me that 8% of U.S. taxes goes towards paying interest on the federal deficit. I hold zero hope for that situation to improve any time soon while no mainstream presidential candidate is even talking about taking on the federal deficit, and the current president is overseeing the largest deficits in history (after squandering the surpluses he inherited from Clinton). They’ve all given up!

Ah, well. It’s nice to know that our tax dollars are being used for some good purposes. I wonder how other countries’ budgets compare? That’s a topic for another day.